The Return of HMRC Preferential Status…

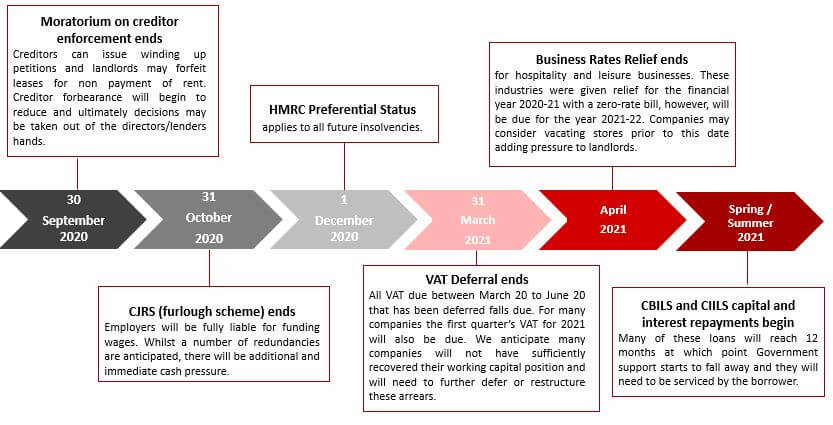

The impact of this change in status and key dates over the next 12 months

On 22 July 2020, the Finance Bill 2019-20 received Royal Assent meaning HMRC will now, once again, have preferential status for direct taxes from 1 December 2020.

What does this mean?

- HMRC preferential status will apply in all formal insolvency appointments from 1 December 2020 onwards.

- Certain HMRC arrears will no longer be unsecured and will rank ahead of floating charge creditors in the order of distribution in the same way certain employee liabilities already do.

- Where a lender does not hold a specific fixed charge or is predominantly reliant on floating charge assets such as inventory, there will almost certainly be a reduced return.

Which HMRC arrears are preferential?

- They are limited to taxes that the company has been collecting on behalf of customers, employees and contractors, being:

- VAT,

- PAYE, employee NI contributions and student loan deductions

- CIS deductions.

Impact on lending

- By allowing companies to defer certain VAT payments to 31 March 21, most businesses will have larger than normal arrears that will rank as preferential after 1 December 2020.

- Those with inventory facilities, overdrafts or term debt are likely to be most affected. Most ABL inventory facilities already build in reserves for employee preferential claims and the prescribed part, however these reserves may need to be adjusted to provide for relevant HMRC arrears.

- We suspect lenders may re-evaluate covenants upon renewing or granting new facilities which may be more difficult for clients to meet.

- The provision and review of accurate and up to date management information, including cash flow forecasts, will become even more important and there should be specific focus on HMRC arrears including where this has accrued but not necessarily fallen due, e.g. VAT paid quarterly.

- Lenders should also be aware that the Prescribed Part increased from £600,000 to £800,000 although this only applies to charges created after 6 April 2020.

Whilst it was hoped that the legislation would at least be postponed in the current climate, many lenders will have been preparing and reviewing their portfolio to identify those clients where the issue will be more problematic. We expect lenders to be monitoring these clients particularly closely in the lead up to 1 December 2020.

Impact on companies

- Companies looking to raise new debt or refinance may find it more difficult where they do not have specifically chargeable assets such as property or receivables.

- The imposition of additional reserves is likely to create additional cash pressure, particularly if VAT payable quarterly is accrued and reserved for monthly.

- Companies with less sophisticated accounting, reporting and cash management systems are likely to find it more difficult to satisfy lenders’ month end requirements.

We expected SMEs, who rely on ABL facilities, and certain sectors such as retail where collateral tends to be in the form of inventory, will be most affected by the changes and yet these are the businesses most in need of support.

When to take action?

HMRC preferential status is just one of a number of pressure points over the next 12 months which will add to the challenges faced by most lenders and their clients as they start to recover from COVID.

Anticipating these stress points and addressing them early is key. It is never too early to take advice. Typically, the longer you wait, the fewer options are available and the worse the overall outcome.

We have experience of advising on a wide range of scenarios, assisting both lenders and their clients through difficult times. A phone call costs nothing, and we are always available to consult.

If you would like to discuss, please get in touch with Tom Straw, Partner of the restructuring team on 02071 86 1148.